|

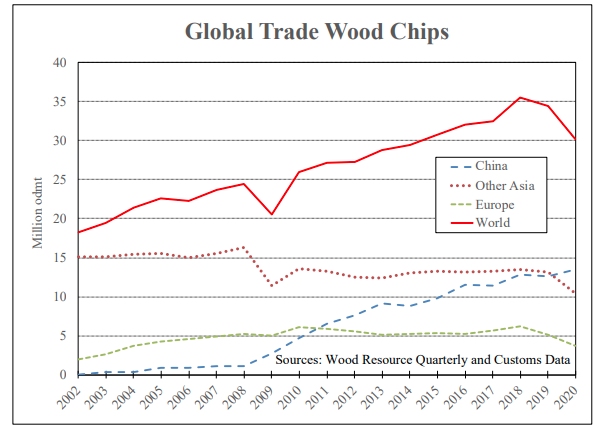

Global Trade of Wood Chips Increased by Almost 50% from 2009 to 2020

May 19, 2021 - Global trade of wood chips, which are mainly used by pulp mills, grew from about 21 million tons in 2009 to an all-time high of 35 million tons in 2018, according to Wood Resource Quarterly. Subsequently, trade declined for two consecutive years to reach just over 30 million tons in 2020. Significant investments in new pulp capacity in China combined with a lack of domestic wood fiber have been driving practically all of the global increase in wood chip trade during the past decade.

Outside of China, the trade of wood chips has been relatively stable the past ten years, ranging between 20-21 million tons annually, except for 2020, when total shipments fell to just under 17 million tons (see chart).

Hardwood chip imports to China reached a new record high of 13.2 million odmt in 2020. This was a 7% increase from the previous year and continued an unprecedented upward trend that started in 2008 when China imported only one million odmt. Although China overtook Japan as the largest hardwood chip importer five years ago, 2020 was the first year when over 50% of the world's traded hardwood chips landed at Chinese ports to feed large, newly built pulp mills in the country.

There were some dramatic changes in Chinese fiber sourcing during 2020, with Australia's shipments falling almost 30% y-o-y and the largest supplier, Vietnam, increasing its sales by 25%. Over the past two years, Chinese pulp mills shifted from importing higher yield fiber quality (HYF) from regions such as Australia, Chile, and Brazil towards lower yield fiber (LYF), from places like Vietnam, Thailand, and Malaysia. The HYF chips would typically be Eucalyptus chips with higher density, often requiring less chemicals in the pulping process.

When the investments in large-scale pulp mills took off in 2008, the preferred wood fiber was predominantly lower quality and lower cost, including Acacia wood chips from Vietnam, Thailand, and Indonesia. Nevertheless, that started to change in 2013-2014 when pulp mills saw the cost and quality benefits of using more high-quality hardwood chips such as Eucalyptus Nitens and Eucalyptus Globulus from Australia and Chile. From 2012 to 2017, the HYF share of total imports dramatically increased from 11% to 47% of the total import volume. However, in 2018, this five-year rise in market share leveled off and fell during 2019 and 2020 to average only 33% in the 4Q/20.

With the supply of hardwood fiber becoming tighter around the Pacific Rim, the fiber sourcing by Chinese pulp mills will likely continue to evolve, including the possibility of new regions coming into play.

Wood Resource Quarterly is published by Wood Resources International, an internationally recognized forest industry consulting firm. For further information visit: www.woodprices.com.

SOURCE: Wood Resources International LLC |

|

|

Suzano to Build 2.3 Million Tons per Year Pulp Mill in Mato Grosso do Sul, Brazil

May 12, 2021 - Suzano today announced that its Board of Directors approved a capital investment BRL 14.7 billion (approx. USD 2.87 billion) for the construction of a new pulp mill to be located in the municipality of Ribas do Rio Pardo, in the state of Mato Grosso do Sul, Brazil.

The proposed pulp mill, referred to by the company as the "Cerrado Project", will have the capacity to produce 2.3 million (two million and three hundred thousand) tons per year of eucalyptus pulp.

Suzano said the funds for the project will distributed between the years of 2021 and 2024, and estimates that the new plant will start operating in the first quarter of 2024.

The approval and the effective execution of the Cerrado Project are subject to:

(i) the Company's commitment to financial discipline, maintaining compliance with the parameters established in the Suzano's Debt Management Policy; and

(ii) the conclusion of the negotiation of the acquisition of the equipment and services necessary to carry out the project, under satisfactory conditions, to be subsequently evaluated and resolved by the Board of Directors.

Suzano said the project will be financed by the company's cash position and cash generation from current businesses, which can be complemented by financing, provided that the conditions are attractive in terms of cost and term.

In a written statement, Suzano said, "The Cerrado Project represents an important advance in the company's long-term strategy, contributing to the expansion of its structural competitiveness, meeting the growing demand for hardwood pulp and Suzano's evolution in sustainability — especially with regard to climate and waste, providing a major carbon capture increase arising from the new forest base.

"In addition, the new plant will have a surplus capacity for renewable energy generation of approximately 180 MW average, and is also considered in the industry as free from fossil fuel — a new milestone for Suzano in eco-efficiency that shows its commitment to society and the planet."

Suzano is one of the largest integrated eucalyptus pulp and paper producers in Latin America. With operations in nearly 60 countries, Suzano is the world's second largest producer of eucalyptus pulp, one of the ten largest producers of market pulp, and the regional market leader in paper for domestic and commercial use.

SOURCE: Suzano S.A. |

|

Paper Excellence Enters Into Definitive Agreement to Acquire Domtar in $3 Billion Deal

(All financial information is in U.S. Dollars)

May 11, 2021 - Paper Excellence and Domtar today announced that they have entered into a strategic business combination under which the Paper Excellence group of companies will acquire all of the issued and outstanding shares of Domtar common stock for $55.50 per share, in cash.

The purchase price represents a premium of approximately 37% to Domtar’s closing share price on May 3, 2021, the last trading day prior to the Domtar’s statement responding to media reports regarding a potential business combination between Domtar and Paper Excellence, and a premium of approximately 44% to the 30-day volume-weighted average price as of May 3, 2021.

The all-cash transaction represents an enterprise value of approximately $3.0 billion.

After the transaction closes, Paper Excellence intends to continue the operations of Domtar as a stand-alone business entity. As such, Domtar will continue to be led by its management team and Paper Excellence plans to retain its corporate and production locations.

Joe Ragan, Global Chief Financial Officer of Paper Excellence, commented, “We are excited to add Domtar and its employees to the Paper Excellence global family. This marks a major step in our global strategy of identifying well-positioned assets and positioning them for growth. Domtar is a natural fit for our culture of operational excellence. We are enthusiastic about entering the American market as we continually improve Paper Excellence’s ability to serve its expanding blue-chip customer base.”

“We have long admired Domtar’s expansive global footprint and believe that it will be a valuable addition to Paper Excellence. We look forward to investing in Domtar’s assets and people for long-term growth,” concluded Mr. Ragan.

“This agreement enables our shareholders to realize certain and immediate cash value at a significant premium for their shares,” said John D. Williams, President and Chief Executive Officer of Domtar. “This transaction validates our long-term strategic plan for our leading paper and pulp businesses, and for our continued expansion into packaging.”

“Our dedicated employees have been instrumental to Domtar’s success and I am glad to see that this transaction supports the strategy that our team has worked so hard to develop over the last several years,” continued Mr. Williams. “As part of Paper Excellence, we will build on that momentum.”

The agreement has been unanimously approved by the Domtar Board of Directors. The transaction is expected to close in the second half of 2021, subject to Domtar shareholder approval, receipt of the required regulatory approvals and other customary closing conditions.

About Domtar

Domtar is a leading provider of a wide variety of fiber-based products including communication, specialty and packaging papers, market pulp and airlaid nonwovens. With approximately 6,400 employees serving more than 50 countries around the world, Domtar is driven by a commitment to turn sustainable wood fiber into useful products that people rely on every day. Domtar’s annual sales are approximately $3.7 billion, and its common stock is traded on the New York and Toronto Stock Exchanges. Domtar’s principal executive office is in Fort Mill, South Carolina. To learn more, visit: www.domtar.com.

Paper Excellence, headquartered in British Columbia, is a manufacturer of pulp and specialty, printing, writing, and packaging papers. The company operates seven mills and a large-scale cargo distribution centre in Canada producing and shipping over 2.8 million tonnes annually with a workforce of more than 2,800. To learn more, visit: www.paperexcellence.com.

SOURCE: paper Excellence |

|

Port Tampa Bay Approves Lease to Celadon for Construction of Recycled Pulp Plant

March 29, 2021 - The Port Tampa Bay Board of Commissioners have approved an agreement with Celadon Development Corporation to lease 37 acres for the construction and operation of a paper fiber manufacturing plant. The plant will have significant economic and sustainability benefits generating up to 20,000 export containers per year (40,000 TEUs), creating approximately 100 jobs and involving a capital investment of $160 million during Phase One of the project.

The facility will receive and process mixed paper, corrugated cardboard and plastic products sourced in Florida to produce recycled pulp in sheets for export to Asia. Environmental and sustainability benefits include increased recycling, water reuse and reduction of greenhouse gases, saving over 1.8 million tons in carbon dioxide emissions.

Phase Two of the project will see the addition of a second production line that will double the plant’s capacity, increasing the output to 40,000 export containers per year (80,000 TEUs), resulting in a total capital investment approaching $400 million.

The site which is on Port Tampa Bay’s Hooker’s Point property is located alongside the Port’s container terminal which is also undergoing a significant phased expansion and is operated by Ports America under a long-term lease. The site is adjacent to the City of Tampa’s wastewater treatment plant with plenty of capacity to accommodate the project’s use of reclaimed water and wastewater needs.

“We are delighted to welcome Celadon to the Port Tampa Bay family,” stated Paul Anderson, Port Tampa Bay President & CEO. “This project will have hundreds of millions of dollars in generational economic impact.”

Raul Alfonso, Executive Vice President & Chief Commercial Officer for Port Tampa Bay, noted, “This project perfectly complements our container development strategy by generating export return loads heading back to Asia and filling containers which arrive with goods for retail and e-commerce distribution centers along the I-4 Corridor. With the Celadon manufacturing plant’s location right next to our container terminal, we expect great synergies and supply chain cost savings.”

Celadon Development Corporation LLC is a partnership between Nicollet Industries and Kamine Development Company, two leaders in green infrastructure and sustainable development.

Port Tampa Bay is Florida’s largest and most diversified port. Given its proximity to the rapidly expanding Tampa Bay/Orlando I-4 Corridor which has emerged as Florida’s Distribution Hub, Port Tampa Bay, and terminal operator Ports America are expanding container terminal facilities to keep pace with this growth. To learn more, visit: www.porttb.com

SOURCE: Port of Tampa Bay |

|

Chilean Wood Chip Exports Down 40% in 2020 as Asian Pulp Mills Increased Imports from Vietnam

March 26, 2021 - Wood chip exports from Chile plummeted in 2020, with shipments falling by over 40% from the first quarter to the fourth quarter. Only an estimated 450,000 odmt were shipped in the 4Q/20, the lowest quarterly volume since the 3Q/15, according to Wood Resource Quarterly. A combination of substantially reduced wood fiber consumption by Japanese pulpmills and an increased supply of lower-cost hardwood chips from Vietnam to Asian markets has contributed to the decline in demand for Chilean Eucalyptus chips in 2020.

Together with Vietnam and Australia, Chile has long been one of the primary wood fiber suppliers to the pulp industry in Japan. In 2013, the country was the number one source of wood chips to Japan, with a market share of 23%. However, the Chilean wood fiber supply in that market has diminished, and the percentage of total imports in the 4Q/20 was down to 11%.

The lower chip sales from Chile contributed to a five-year low in total wood chip shipments from Latin America in the 4Q/20. In just three years, the continent's export volume has fallen from 1.24 million odmt in the 4Q/17 to about 720,000 odmt in the 4Q/20.

Exports by Brazil have been relatively steady the past few years, ranging between 200,000-300,000 odmt per quarter.

Shipments from Uruguay, the third largest wood chips exporter on the continent, stopped entirely in the second half of 2020. The halt in shipments followed a long period when the country supplied pulp mills in Europe, predominantly Portugal, with between 500,000 and one million odmt of Eucalyptus chips annually.

The declining demand for hardwood chips by Asian pulp mills in 2020 has substantially reduced export prices (FOB) in Brazil and Chile, Wood Resource Quarterly said. The Latin American Wood Chip Export Price Index fell in the second half of 2020 to its lowest price in over ten years.

Wood Resource Quarterly is published by Wood Resources International, an internationally recognized forest industry consulting firm. For further information visit: www.woodprices.com.

SOURCE: Wood Resource Quarterly LLC |

|

|