|

IFPTA and TTOBMA Enter Collaboration to Organize 2026 Global Forest Products Transport Symposium

September 25, 2024 - The International Forest Products Transportation Association (IFPTA) and TTOBMA, a leading forest products market intelligence firm, are proud to announce their collaboration on the first Global Forest Products Transport Symposium.

This biennial conference will alternate between major North, Central, or South American and European port cities, with the inaugural Fall 2026 Global Forest Products Transport Symposium to be held in the Americas. The selected city will be announced in early 2025.

The IFPTA hosted the first PPI Transport Symposium 50 years ago, in 1974, which took place in Rotterdam. The IFPTA is proud to continue the rich history and unparalleled networking opportunities that the industry has come to rely on. The Global Forest Products Transport Symposium is the only conference dedicated to logistics, supply chain, and sales & marketing professionals in the forest products sector.

“We are excited to bring together industry experts, thought leaders, and other stakeholders to explore the latest trends and technologies in distribution, in what has become a critical component to the success of all companies operating in the forest products industry” states Fraser Hart, Managing Partner of TTOBMA.

Bob Davidson, President of IFPTA reiterated, “The Global Forest Products Transport Symposium is the only conference in the world dedicated to logistics for the forest products industry and is a must-attend event for stakeholders in this community.”

For more information, please contact Michael O’Brien at IFPTA ([email protected]) or TTOBMA ([email protected]).

About IFTPA

The International Forest Products Transport Association (IFPTA) is an international association of forest products logistics professionals.

International transport of forest products demands integrated efforts of many disciplines. Foresters, mill managers, chemical and clay producers, traffic and logistics managers, must all talk to and work with rail and trucking representatives, marine transporters, stevedores, port and terminal operators, and manufacturers of handling equipment. The IFPTA seeks to establish a permanent framework to ensure continued vitality, and within which professional experience and information can be shared in a timely manner.

About TTOBMA

TTOBMA provides reliable and up-to-date pulp and paper market intelligence through its TTO and BMA divisions. TTO publishes monthly pulp, recovered paper, and tissue net-price indices for benchmark grades in major markets like China, Europe and North America based on open-market transactions. BMA helps subscribers understand and track current pulp and paper market conditions and to forecast short to long-term trends in demand, supply, and net prices.

SOURCE: IFPTA and TTOBMA |

|

|

G2 Ocean Fleet Expands with Two Additional Dual-Fuel Vessels

Aug. 26, 2024 - G2 Ocean, the world’s largest shipping operator in the Open Hatch segment, announced the further expansion of its fleet with two 82,300 deadweight ton (dwt) ammonia/methanol-ready Open Hatch vessels.

These new vessels, will be provided by Gearbulk, one of G2 Ocean’s valued shareholders and pool partners.

These units will be sister vessels to the previously ordered Pulpmax vessels ordered earlier this year, and will be built in the same shipyard. The vessels will be delivered in October 2028 and January 2029.

In addition to these new vessels, G2 Ocean previously announced that Grieg Maritime Group, shareholder and pool partner, will be providing four ammonia-ready vessels to its fleet in 2026 and Gearbulk will be providing four ammonia-ready vessels in the first half of 2027. This will bring the total number of dual-fuel 82,300 dwt Open Hatch vessels to ten.

The design of these vessels strengthens our service offering and will help us to meet evolving customer requirements. We very much appreciate the support of Gearbulk and Grieg Maritime Group on these newbuilds, says Arthur English, CEO of G2 Ocean.

With the ten Pulpmax vessels ordered we can take important steps on our decarbonisation journey, on our target of becoming net-zero by 2050,” English said.

Pulpmax Specs:

- 8 holds / hatches

- 4 electro-hydraulic jib cranes with safe working load (SWL) lifting capacity of 2x 75 metric tonnes and 2x 120 metric tonnes

- Dedicated deck space on either side of the accommodation for the future installation of fuel tanks for alternative fuels

- LOA of 225 meters and beam of 36 meters

G2 Ocean is a joint venture of two of the world’s largest open hatch shipowning companies Gearbulk and Grieg Maritime Group. Since the company was launched in 2017, G2 Ocean has become one of the world’s largest ship operators within the open hatch segment.

SOURCE: G2 Ocean |

|

Metsä Fibre Has Started Pulp Deliveries to Green Bay, Wisconsin

May 28, 2024 - This spring, Metsä Fibre started regular pulp deliveries to Green Bay, Wisconsin, in the United States.

According to the company, “The port of Green Bay is close to paper mills in the Wisconsin area, which are significant users of market pulp. Our first pulp shipment set off from Rauma, carrying softwood pulp, which will be used, among other things, for the production of tissue and specialty papers.”

Kustaa Laine, VP, Sales, Americas & MEA, Metsä Fibre, explained, “This new route increases the reliability of our supply chain and supports the expansion and growth of our sales in the North American market.”

Metsä Fibre Pulp Capacity

- Joutseno pulp mill: 690,000 tonnes per year (tpy) of softwood pulp

- Kemi bioproduct mill: 1,020,000 tpy of softwood pulp, 300,000 tpy of hardwood pulp, and 180,000 tpy of unbleached pulp.

- Rauma pulp mill: 650,000 tpy of softwood pulp.

- Äänekoski bioproduct mill: 800,000 tpy of softwood pulp, and 500,000 tpy of hardwood pulp.

Metsä Fibre is a leading producer of wood-based bioproducts, such as pulp, sawn timber, biochemicals and bioenergy. With about 1,600 employees, the company produces pulp and bioproducts at its four mills and sawn timber products at four sawmills in Finland.

SOURCE: Metsä Fibre

|

|

Red Sea Crisis Hits Swedish Exports of Forest Products

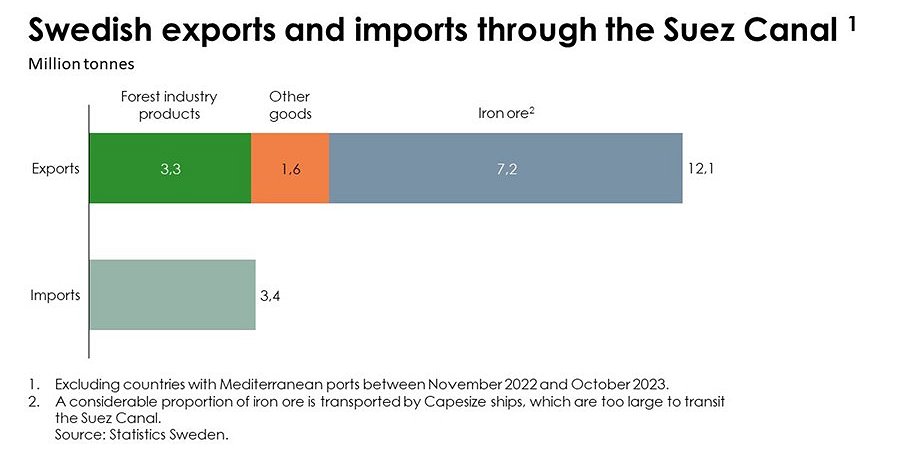

One in three ships transporting Swedish goods that transits the Suez Canal carries forest products. Houthi rebel attacks on merchant ships in the Red Sea are deterring traffic through the canal, resulting in supply chain uncertainty and increased costs.

Feb. 7, 2024 - Sweden is one of the world’s largest producers of pulp, paper and sawn wood products. Eighty per cent of Swedish forest industry products are sold to other countries. This means that the sector provides climate benefits all over the world, but that it is also dependent on resilient logistics.

“We calculate that our industry is the single largest transport buyer of container freight from Sweden via the Suez Canal, where costs have now unexpectedly jumped by 100 to 200 per cent, so we view the future with some concern. There is a risk of container shortages, delays and disruption. Going around the Cape of Good Hope instead of via the [Suez] Canal can take up to 30 extra days for a round trip,” says Christian Nielsen, Market Expert Wood Products at Swedish Forest Industries.

“The current situation may continue for some time and result in cost increases, but above all increased uncertainty for the industry and for forest industry customers. However, since the autumn, there has been overcapacity of containers and vessels. Until now, shipping rates from Europe to Asia have been unusually low, which reduces near-term risk and helps calm the situation somewhat,” Nielsen says.

How are Swedish producers affected?

“In many cases, suppliers, especially of wood products, have managed to agree to share the increased costs with their customers. But of course they are affected. We’re already facing deteriorating economic conditions with falling prices, while production costs remain generally high. Margins are under more pressure than normal, which can have a severe impact on individual deliveries during this period. But over time, for new contracts, we believe that in many cases these are costs that customers in Asia will have to bear,” says Nielsen.

There are few alternatives to sawnwood imports from Europe, which appears to affect finished product prices in the region. The outlook is less certain for pulp and paper in terms of the impacts of cost increases and longer delivery times. Competition from other global suppliers is fiercer in these segments.

“This doesn’t necessarily mean that Swedish pulp producers will be hit harder than wood product producers. Competition is tougher in pulp and paper markets, but disruption to shipping will also affect imports of paper to Europe from low-cost producers in Asia. This could potentially increase demand in Europe.”

Will this also result in increased costs for wood products, pulp and cardboard on the Swedish market?

“No, I don’t think so. It’ll mainly affect our customers in Asia,” Nielsen says.

Facts

Of Sweden’s total forest industry exports, approximately 10 – 15 per cent were previously shipped via the Suez Canal and the Red Sea to customers in the Middle East and Asia. One third of Swedish exports (by volume) shipped via the Suez Canal are forest industry products. This is almost as much as Sweden’s total imports that transit the canal.

SOURCE: Swedish Forest Industries |

|

G2 Ocean Adds Two More Ammonia-Ready Vessels to Its Fleet

Sept. 11, 2023 - G2 Ocean has achieved another milestone in its sustainable growth strategy with an additional two ammonia-ready vessels being delivered to its pool in 2026 by its shareholder, the Grieg Maritime Group (Grieg).

Following its commitment to only purchase newbuilt vessels with zero-emission technology, Grieg signed a contract in May 2023 with the shipyard CSSC Huangpu Wenchong Longxue which included two firm plus two optional 82,300 deadweight tonne (dwt) ammonia-ready open hatch vessels. Last week, Grieg exercised its option for the two additional vessels. All four vessels will be delivered to G2 Ocean’s pool in 2026.

“With this expansion, G2 Ocean is increasing its carrying capacity and further demonstrating its commitment to providing flexible and sustainable shipping solutions to our customers,” said Arthur English, Chief Executive Officer at G2 Ocean.

Equipped with duel-fuel engines, 120 metric tonnes crane capacity, tween decks, a battery package to make peak-shaving a possibility and shore power options, the Chinese-built vessels will be the largest, most environmentally friendly, and technologically advanced carriers in the G2 Ocean fleet.

“The design and size of the vessels make them very flexible, allowing us to meet the requirements of our customers worldwide. With this delivery, we are also able to take another important step on our decarbonisation journey and our target of becoming net-zero by 2050,” English said.

About the Vessels

The vessels have a capacity of 82,300 deadweight ton.

All vessels will have:

- dual-fuel engines allowing them to operate both on fuel oil and ammonia

- two centre Variable Frequency Drive (VFD) fully electric cranes that will be able to lift 120 metric tons each, with a tandem of 240 metric tons. Front and aft will have two 75 metric tons VFD fully electric cranes.

- tweendecks in the middle holds

- shore-power possibility

CSSC Huangpu Wenchong Longxue are building the vessels in China and the ships will be delivered to G2 Ocean in 2026.

SOURCE: G2 Ocean |

|

|