|

Wisconsin Paper Group Marks 90 Years of Shipping Excellence

Jan. 29, 2024 - A Fox Valley-based shipper’s association has been helping its members realize a competitive advantage for 90 years and counting. In 1934, a group of 13 enterprising paper mill executives started the Wisconsin Paper Group to provide their paper companies with the best possible shipping services. Wisconsin Paper Group was the first not-for-profit shipping cooperative in the nation and remains the only shipper’s association of its kind nine decades later.

“By starting the Wisconsin Paper Group, the individual members of the association could guarantee faster and more frequent deliveries of their products at a lower cost,” said Tim Metten, President of Wisconsin Paper Group, located at 634 Muttart Road, Neenah, Wisconsin. “Today, this cost-saving mindset benefits all members by keeping freight rates lower than individual companies could achieve on their own.”

To celebrate its 90th anniversary, WPG will host an event summer 2024, with the details published on the WPG LinkedIn and Facebook profiles.

The Wisconsin Paper Group, also known as The WPG Shippers Association, acts as an extension of their members’ logistics teams. Members tender orders for less-than-truckload and shared truckload shipments to WPG for consolidation into multi-stop or single-stop truckload deliveries.

“Every shipment is important to us, and we treat it as our own. Our passion is transportation,” Metten said.

WPG utilizes linehaul carriers and regional distributors to deliver freight throughout the United States, Canada, Mexico, and Puerto Rico. In addition to ground transportation, WPG also provides Air Freight services and warehousing services.

Originally, WPG handled paper. Through the years, WPG expanded its commodity base to include packaging, plastics, and other paper-related cargo. In 2000, WPG expanded further, handling fabricated metal, primary metal, lumber and wood, furniture and fixtures, nonperishable food and kindred products, machinery, and transportation equipment.

“While much has changed in manufacturing, transportation and logistics, the primary goal of our organization remains the same, even after 90 years. By using a cooperative approach, Members send as much volume as possible through our consolidation network to build more efficient loads, driving down costs,” Metten said.

The Wisconsin Paper Group was established in 1934, uniquely formed as a not-for-profit shipper’s association. Today, WPG represents over 100 Wisconsin and Upper Michigan companies.

SOURCE: The Wisconsin Paper Council (newsletter) |

|

|

Resolute Invests in Innovative Truck Platooning Technology

Sept. 13, 2023 (From Resolute’s blog) - Resolute Forest Products is helping advance an exciting off-highway automated vehicle (AV) technology known as truck platooning. Truck platooning involves a convoy of trucks that are linked together electronically, all operated by an experienced driver in the lead truck. The rest of the trucks in the convoy respond to the lead driver’s movements through a drive-by-wire and autonomy system.

The project is spearheaded by FPInnovations, a private not-for-profit R&D organization that specializes in developing solutions to make the Canadian forest products sector more competitive. The project has received funding from Quebec’s Société du Plan Nord as well as from Natural Resources Canada’s Forest Innovation Program. The project can count on the vast expertise of the technological partner, Robotic Research Autonomous Industries (RRAI).

In addition to funding, Resolute is providing testing terrain and logistical support. Baseline testing for the technology was completed last month on Resolute land in Quebec’s Matagami region. The test utilized a pickup truck prototype in summer and winter conditions. Upcoming phases will examine performance in more challenging scenarios using loaded freight in cold, icy and low-light conditions with full scale Class 8 Trucks, equipped with RRAI’s “AutoDrive® autonomous platform”.

Testing is set to continue until 2026.

Truck platooning offers many advantages for our industry and beyond. In addition to helping address the ongoing shortage of truck drivers and operators, the technology makes trucking more efficient, reduces greenhouse gas (GHG) emissions and fuel costs, improves safety for all road users on remote roads and highways, and generates positive socio-economic impacts for northern communities. These benefits apply to all resource roads and are likely to extend to other sectors, including mining and transportation in remote areas. The technology’s potential for reducing GHG emissions through better driving efficiency supports the global transition to a net-zero economy. Resolute is proud to be a key player in this important project.

SOURCE: Resolute Forest Products |

|

ContainerPort Group Further Develops Operations in Philadelphia

March 13, 2023 - In response to increased demand in Philadelphia, ContainerPort Group (CPG®), a nationwide trucking carrier specializing in drayage solutions, announced an expanded footprint in the market with additional freight capacity and increased driver support.

“As the cargo continues to flow through the east coast, our customers are turning to us for additional trucking capacity throughout the Northeast, and particularly in Philadelphia. We already have a presence across other ports including New York/New Jersey, Norfolk, Baltimore, and more, so broadening our footprint to include Philadelphia was a next logical step for our business and for our customers,” said Joey Palmer, President, CPG. “We will continue to grow and deepen our presence in the region based on the needs of our customers and the market.”

To help support operations, the company has already added several veteran owner operators carrying a variety of endorsements, as well as a fleet of private chassis. Customers can take advantage of Philadelphia’s centralized location to reach nearly 41 million people within a 150-mile radius of the port.

CPG’s growth in Philadelphia demonstrates the company’s commitment to providing nationwide coverage at every port and every rail. Earlier this month, CPG announced it had opened a new terminal in Jacksonville to accommodate growing demand in the Southeast region. Additionally, the company recently began offering Dedicated Services across several locations, providing guaranteed capacity to customers needing white-glove service.

As CPG adds to its national network, it also continues to expand its fleet and provide tools to its drivers to ensure they are prepared to meet the increased demand. CPG recently introduced DrayPal, a custom mobile app designed to allow drivers to instantly access crucial information that helps them run a smarter, more efficient business.

“Much of our strategy for growth is driven by customer demand. This is not only reflected in our decision to expand our footprint in Philly and Jacksonville, but it can also be seen in our evolving portfolio of services and solutions,” said Mr. Palmer. “Our goal is to be everywhere our customers need us to be, and to provide the solutions both our drivers and our customers need.”

SOURCE: ContainerPort Group |

|

Kruger Energy’s First Two All-Electric Class 8 Tractor-Trailers Now on the Road

Jan. 19, 2023 – Kruger Energy is proud to be one of the pioneers as its two 100% electric semi-trailer trucks have started to carry materials and Cashmere®, SpongeTowels® and Bonterra™ tissue products, between two Kruger Products facilities in Québec. These are among the first all-electric class 8 vehicles operating in Canada, and the first in the Canadian tissue industry. The vehicles have been branded with visuals illustrating Kruger Energy’s activities related to the development and management of renewable energy power assets.

“We are excited to take our first steps in transport electrification, a goal that aligns perfectly with Kruger Energy’s mission to develop renewable energy solutions that are beneficial to the environment and our communities. The data collected from the electric truck batteries will help further expand our expertise in energy storage, which is critical to renewable energy production. Also, we are already planning to expand our fleet of alternatively fuelled vehicles,” said Jean Roy, Chief Operating Officer of Kruger Energy.

The two electric trucks will replace one standard diesel truck and will enable the Company to reduce its GHG emissions by 380 tons of CO2 per year, which is equivalent to removing about 90 passenger cars from our roads. Reduction of fossil fuel use will amount to 150 000 litres per year for each truck. The trucks are operating 20 hours a day, 7 days a week, travelling at full capacity more than 1,000 km between the two facilities daily or 365,000 km each year. Besides the positive impact on air quality, these zero-emission trucks will also help to reduce noise pollution with their quiet all-electric powertrain.

“When we embarked on Reimagine 2030, Kruger Products’ sustainability strategy, we knew that we had to dig even deeper to find viable sustainable solutions allowing us to continue to grow as a business, while also shrinking our environmental footprint,” added Dino Bianco, CEO, Kruger Products. “These two electric vehicles represent the first of many steps we are taking to continue to reduce our greenhouse gas emissions. As the leading tissue manufacturer in Canada, we have a responsibility to offer consumers and our customers high quality products while also protecting our environment.”

The acquisition of these two trucks is only the beginning, as Kruger aims to electrify a large part of its fleet in the coming years. The company has ordered 50 additional electric trucks, of which 15 to 20 should hit the road within the next 24 months.

Helping the Entire Industry Make Transportation Greener

Kruger Energy acquired its own charging stations, which sets the company apart from other early users and allows it to collect a trove of information about the vehicles’ performance. Once gathered, the data can be used by Kruger Energy to offer fleet electrification services to other companies looking to increase sustainable modes of transport within their supply chain.

This goal aligns perfectly with Kruger and its subsidiaries’ commitment to keep reducing their environmental impact. Early in 2021, Kruger Products became the first tissue company to sign the Canada Plastics Pact, and the Company continues to invest in different opportunities to enhance its energy and GHG efficiency at its plants across Canada and the U.S.

About Kruger Energy

Kruger Energy is a business unit of Kruger Inc. and specializes in the development and management of renewable energy power plants. Taking into account hydro, wind, biomass cogeneration and solar facilities, Kruger Inc. and Kruger Energy manage and operate 42 production sites across North America, with a combined installed capacity of 542 MW.

About Kruger Products Inc.

Kruger Products is Canada’s leading manufacturer of quality tissue products for households, industrial and commercial use.

SOURCE: Kruger Inc. |

|

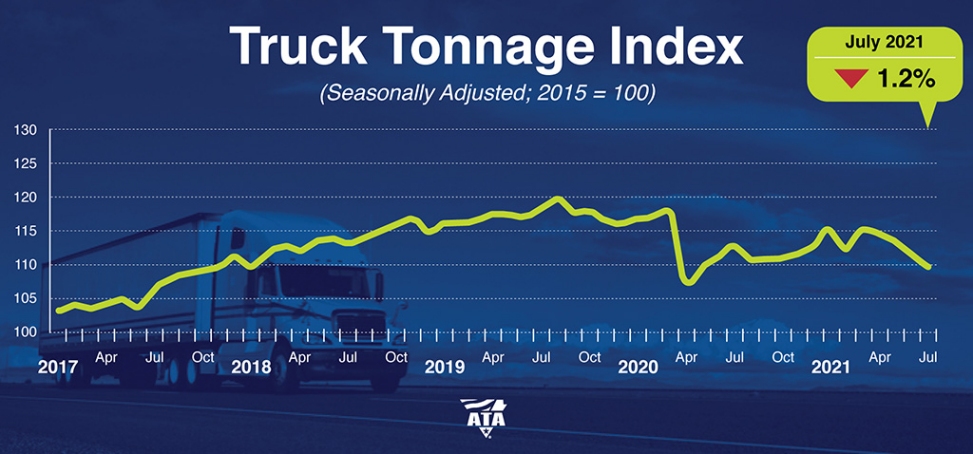

ATA Truck Tonnage Index Decreased 1.2% in July

Aug. 24, 2021 - American Trucking Associations’ advanced seasonally adjusted (SA) For-Hire Truck Tonnage Index decreased 1.2% in July after falling 2% in June. In July, the index equaled 109.8 (2015=100) compared with 111.1 in June.

“Softness in tonnage over the last few months is due more to supply constraints, rather than a big drop in freight volumes,” said ATA Chief Economist Bob Costello. “Not only are there broader supply chain issues, like semiconductors, holding tonnage back, but there are also industry specific difficulties, including the driver shortage and lack of equipment. For-hire truckload carriers are operating fewer trucks than a year earlier. It is difficult to haul significantly more freight with fewer trucks and drivers.

“In addition to these supply issues, retail sales and housing starts, both large drivers of truck freight, retreated in July, although both rose on a year-over-year basis,” he said.

June’s reading was revised down to -2% from our July 20 press release.

Compared with July 2020, the SA index fell 2.9%, which was the first year-over-year drop since March. In June, the index was flat from a year earlier. Year-to-date, compared with the same seven months in 2020, tonnage is down 0.2%.

The not seasonally adjusted index, which represents the change in tonnage actually hauled by the fleets before any seasonal adjustment, equaled 111.9 in July, 3.2% below the June level (115.6). In calculating the index, 100 represents 2015. ATA’s For-Hire Truck Tonnage Index is dominated by contract freight as opposed to spot market freight.

Trucking serves as a barometer of the U.S. economy, representing 72.5% of tonnage carried by all modes of domestic freight transportation, including manufactured and retail goods. Trucks hauled 11.84 billion tons of freight in 2019. Motor carriers collected $791.7 billion, or 80.4% of total revenue earned by all transport modes.

ATA calculates the tonnage index based on surveys from its membership and has been doing so since the 1970s. This is a preliminary figure and subject to change in the final report issued around the 5th day of each month. The report includes month-to-month and year-over-year results, relevant economic comparisons, and key financial indicators.

SOURCE: American Trucking Associations (ATA) |

|

|